Whitmer, lawmakers and MEA retirees celebrate rollback of pension tax

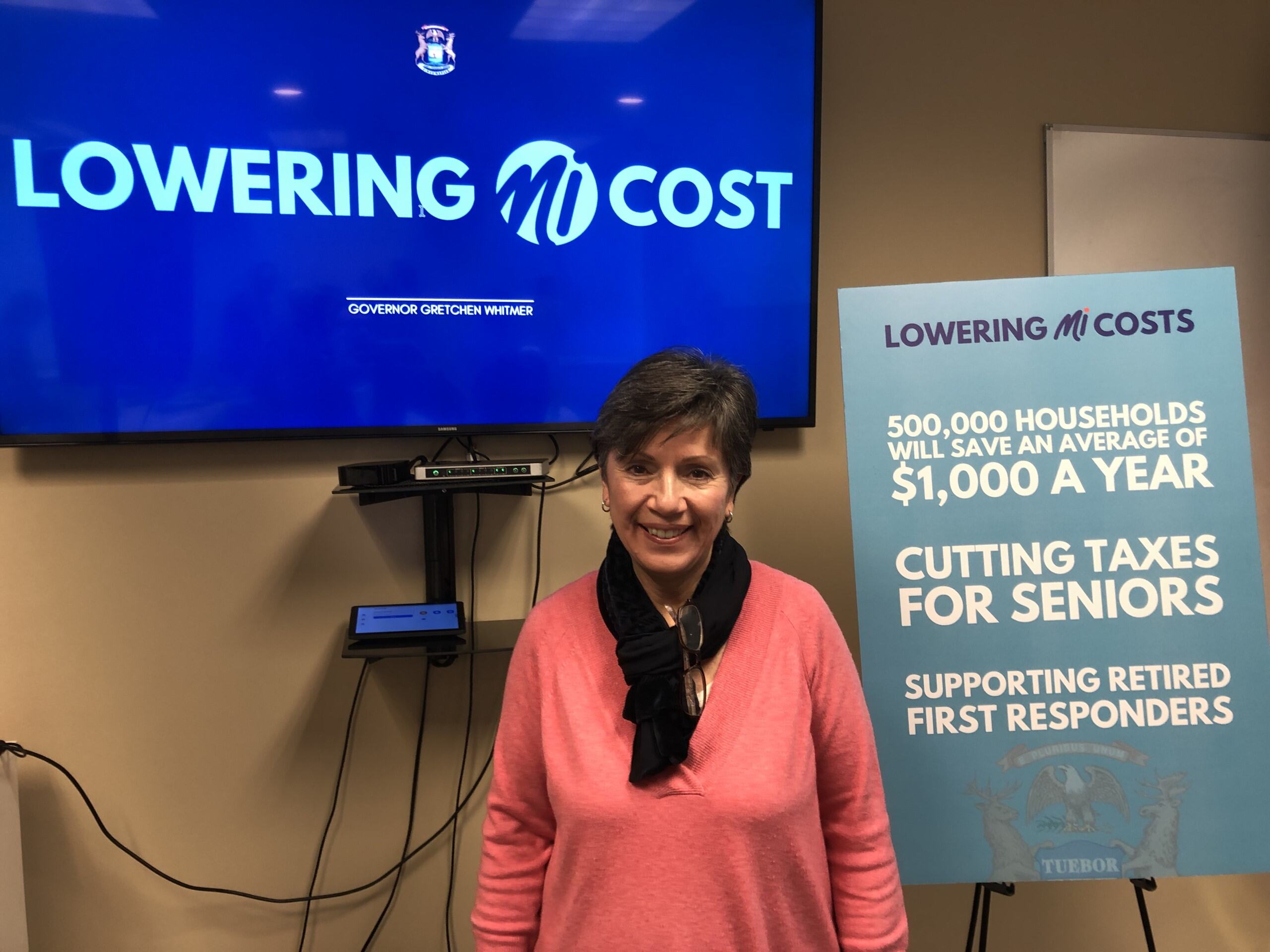

Retired educator Isabell Nazar could not mathematically pinpoint the positive effects of a new law that will save her pension from being taxed; instead the former 38-year middle school science teacher from rural Homer in Calhoun County declared, “It will improve my life to the nth degree.”

A board member of MEA-Retired, Nazar was among dozens of retired educators who recently turned out alongside Gov. Gretchen Whitmer and several lawmakers at MEA offices near Grand Rapids to celebrate the law passed last spring which begins phasing out the unfair retirement tax this year.

“I’m a hearing-disabled American, and with this money I’ll be able to get my hearing aids upgraded,” Nazar said. “I’m a singer, and with my basic hearing aid the piano sounds tinny. Now I’ll be able to hear music in beautiful surround sound, which is so important to me and my quality of life.”

Many retirees who need a hearing aid can’t afford one at all, and going without undermines mental cognition and health, said Nazar, who testified before the Legislature last spring to urge passage of the tax rollback. “Having $1,000 back to spend on basic needs will be an absolute godsend for people.”

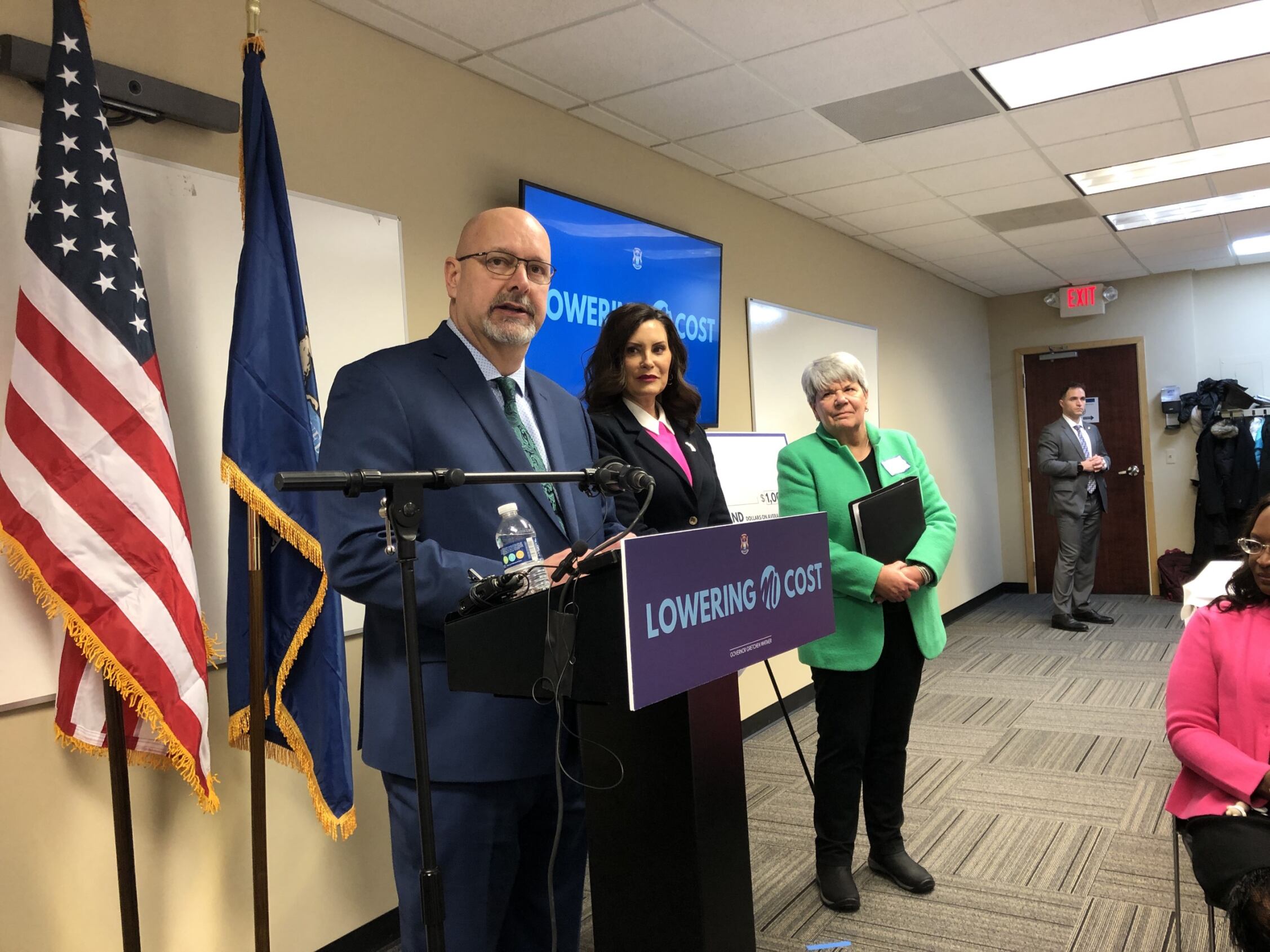

In remarks to the crowd and assembled media at the event last Thursday, Whitmer said she prioritized the retiree tax change since taking office in 2019 but couldn’t get it done without partners in the Legislature who agreed it was unfair to pull the rug out from under retirees living on fixed incomes.

“I’ve been trying to get this done for five years, but it wasn’t until 2023 with a new Legislature that we were able to get this over the finish line,” Whitmer said to applause. “With the first Democratic majority in 40 years, we’ve rolled back the retirement tax on seniors, saving half a million households an average of $1,000 a year.”

As a state senator in 2011, Whitmer opposed moves by Gov. Rick Snyder and the Republican-controlled Legislature to finance a massive corporate tax cut by taxing public-employee pensions, slashing the Earned Income Tax Credit (EITC) for low-income working families, and gutting education funding.

“Three moves that were wrong until we rectified them in these last couple years,” Whitmer said, also pointing to fixes that include record investments in public education and a quintupling of the EITC – now called the Working Families Tax Credit – to return thousands of dollars to households where more than half of the state’s children reside.

“While everyone talks about children being our future, not every state walks the walk – and here in Michigan we do,” she said.

MEA Vice President Brett Smith thanked the governor and lawmakers for delivering on behalf of teachers and support staff who deserve relief from hardships imposed by shouldering more than their share of costs over the past dozen years.

“As we look around the room, we see retired educators who held up their end of the bargain through a lifetime of service to Michigan students, parents and families,” Smith said. “Thanks to Gov. Whitmer and our pro-education majority in the Legislature, Michigan will once again hold up its end of the bargain.”

Signed into law last March, the plan known as Lowering MI Costs phases in the pension tax rollback over four years with incremental changes beginning with tax year 2023 – for tax returns to be filed in 2024 – depending on taxpayer age. Retirees can also choose to file under the old rules.

By tax year 2026, the pre-2012 retirement and pension subtraction will be restored for most taxpayers in Michigan.

Among several lawmakers in attendance at the event, state Rep. Phil Skaggs (D-East Grand Rapids) said lowering taxes for working families and retired folks is part of the governor’s larger vision for growing Michigan by lifting up individuals in addition to encouraging business investment.

Skaggs quipped that eliminating the state’s retirement tax is about “grandma retention” because it removes one incentive for moving away.

In her remarks, MEA-Retired president Kay Walker-Telma added it’s also about teacher retention. One of her invited guests at Thursday’s event was MEA member Amy Pavelka, a still-active school counselor.

“My dear friend Amy makes a difference in the lives of students, staff and families every day as an award-winning counselor at nearby Forest Hills Eastern Middle School,” Walker-Telma said. “She will be eligible to join the ranks of the retired in the near future, and when she does she will join the hundreds of thousands who will be positively impacted by this legislation.”

Pavelka said she joined the celebration because the governor’s leadership and the Legislature’s support have resulted in meaningful education improvements over the past few years which are encouraging to those still working in and committed to public schools.

“It fosters hope every day when we come in to do that wonderful, important work with our future leaders,” Pavelka said.

In turn, Whitmer thanked those in attendance for their hard work and support in electing pro-education candidates. “Thank you for your advocacy,” she said. “We would not be here today celebrating this moment without you, and we will continue doing great work together.”